Business of Publishing: How to Write a P&L statement

This is the ninth post in our ongoing Business of Publishing series by Joe Biel, the author of A People’s Guide to Publishing. This edition tackles an important but more advanced question, “how much can I afford to spend on the book that I am publishing?”

While, on the surface, any answer to a question like this seems to be built from a steady diet of bullshit, books are remarkably consistent. Unlike cookies or soft drinks, most books are not branded. A book from a major house sits next to your book and others from indie presses. If you’ve successfully developed your book, you are providing each reader with enough information to make a choice based on their own experiences, observations, and tastes.

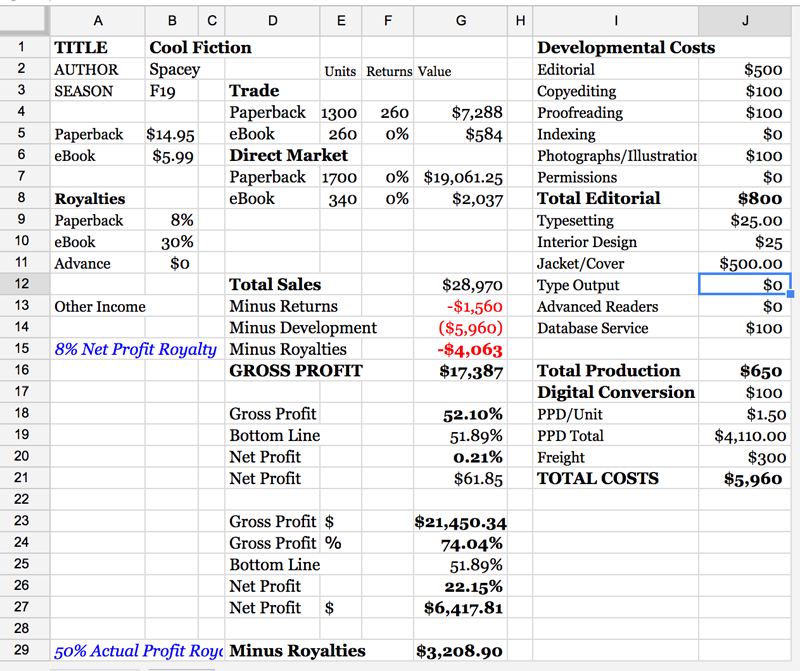

Let’s begin! For those following along at home, I’ve created this spreadsheet that you can download or duplicate and edit. And as you’ll see, there are fairly predictable formulas for everything.

The upper left hand corner begins with the title, author, and book’s release season. Lines 5 and 6 include retail prices for each format. If you’re doing a hardcover, you’d include that as well. Lines 9 and 10 list the author’s royalty by format as well as any advance payment that they receive. Traditionally this advance is your projected first two years of royalties paid in advance.

Line 13 is income from selling film or translation rights or foreign territory rights but it’s best not to plan for this in advance since even commitments can fall apart as the licensee changes their plans.

Beginning in column D, lines 4-5 predict what will likely be the sales in bookstores as well as returns and revenues. These numbers are based on your comparable titles and their selling habits. It’s best to be conservative here so that your expectations are reasonable and you aren’t shocked when you see your actual sales and returns.

Lines 7-8 predict similar sales in the direct market, which would include sales at your own events, via your own website, to non-trade stores that buy non-returnable, and books sold to the author. Again, these numbers should be conservative and based on figures in reality that you are seeing elsewhere.

Scooting over to column I, we’re looking at the publisher’s expenses for putting the book together from editorial to production to licensing to eBook conversion to paper, printing, and binding costs. Fiddle with these numbers to see what you can afford for a project before committing with an author.

Next, back on column D and lines 12-16, we’re looking at sales minus returns minus development costs minus author royalties. This will tell you what your gross profit is.

Next, we subtract operating costs (“the bottom line”), like rent, staff, telephones, envelopes, warehousing, etc. These should comprise every expense that you’ll have to pay for even if you don’t work on a book during a given month. Subtracting your gross profit from your bottom line will tell you how much actual profit the publisher is earning from each book. In this example, it’s less than $62. This example represents the most statistically likely outcome for a book like this. Publishing is about volume so to make up for these low returns, you can either produce tons and tons of books (called a “paper mill” in the industry”) or land a few heavy hitters every year. Your choice, kind of.

Another vital part of the P&L is to evaluate a year or two later how well the book did against expectations. If a book does not sell as well as expected, it’s important to figure out why. Was tons of new competition added? Did interest in the subject fade away? Was it revealed that the author’s cure for cancer was actually bogus and their credibility tanked? Was there a major developmental error in the cover/title/subtitle that confused readers about what the book offered or how it was unique? Answer these questions. Similarly, if a book did better than expected, it’s similarly important to figure out why and repeat these events with other titles.

Alternately, to demonstrate how these traditional contracts still benefit the author, I showed an alternate royalty model where the author takes 50% of the profit. But as you can see, comparing cell G29 to G15, 8% of the cover price ends up being more than 50% of gross profit in most cases until you really land a bestseller.

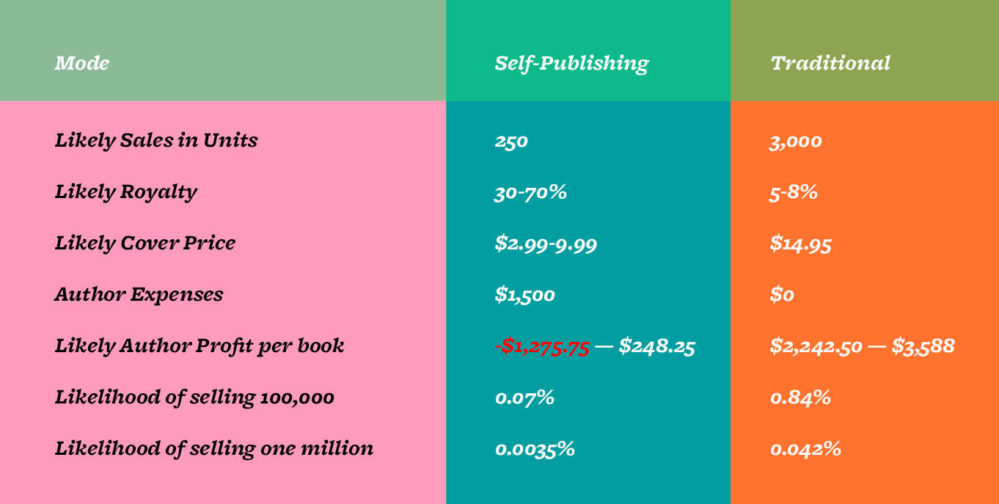

Due to Amazon’s immense marketing budget and campaign to convince authors that publishers are greedy and obsolete, many authors don’t understand why the traditional 4-8% paperback royalty is still much more in their favor than self-publishing on Kindle and CreateSpace so I’ve made a chart for that too.